E-wallets are software programs which securely store data. This data is needed to enable the wallet owner to conduct payments online or at points-of-sale. And they do so by use of a specific device.

That’s as close to an encompassing definition of e-wallets, or electronic wallets respectively, as we will probably get. But it’s also just the surface of what electronic wallets – sometimes also called digital wallets or (obsoletely) cyberwallets – can do. Over the last decade, e-wallet technology has found application to a variety of use cases. This article will cast a light on the term E-wallet, especially in the context of online payments. In the following paragraphs you’ll find:

- Definitions of certain types of e-wallets

- An overview of their common functionalities

- A breakdown of e-wallet-based payment

- An outlook on their role in the future of payments and e-commerce

What Types of E-Wallets Do Exist?

Out in the wild, different types of e-wallets contrast in composition and functionalities. Following our initial definition, we can distinguish those wallets by their software and devices they run on. With regards to data: We will see that most e-wallets process similar data sets.

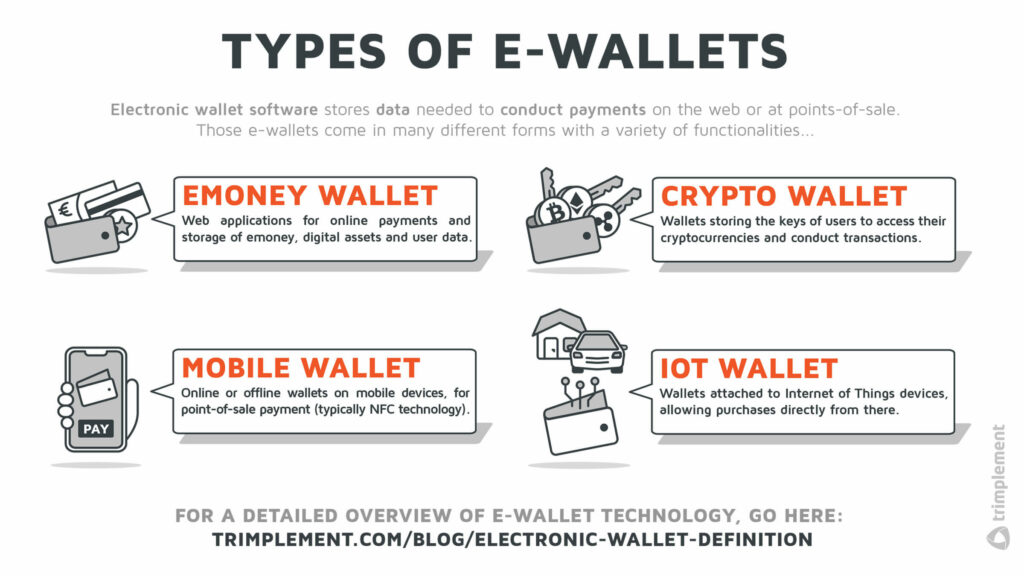

Basically, we can identify 4 basic types of electronic wallets: Digital Wallets, Crypto Wallets, Mobile Wallets and IoT Wallets. All of them act as umbrella terms for very specific wallet configurations, which may vary according to a number of criteria.

Of course, the classifications below will sometimes overlap. Specific e-wallets can comprise functions from more than one of the categories presented here. For example, there are wallets which function as NFC payment apps at points-of-sale and also as payment instruments for e-commerce platforms.

1. Digital Wallets / E-Money Wallets

This type of e-wallet is regarded as the “standard” use case. That’s why many use the terms e-wallet and digital wallet synonymously. For our purposes though, we want to present digital wallets or online wallets as a subcategory, to better differentiate them from electronic wallets as a basic concept. Following our definition, digital wallets are typically web applications that can be accessed from any device that’s able to connect to the internet.

Digital wallets are part of a central web platform, run by the wallet provider. There, users can top up or withdraw from their e-money balance using payment instruments stored in the e-wallet. In addition, they can pay for e-commerce purchases either using available e-money or by charging a stored payment instrument. Popular examples are PayPal or Amazon Pay.

Some banks also offer custom digital wallet apps with features like budgeting or alert notifications. In the area of microfinancing, e-wallets have become a staple for many small businesses.

Finally, certain digital wallets store assets other than fiat currencies. Take loyalty points or even strictly informational data like coupons or discount codes, for example. Many such stored values only circulate within a closed loop, so the values can only be spent in certain contexts, like on specific e-commerce platforms.

At trimplement, our expertise lies with digital wallets as defined in this paragraph. It’s this use case that we will go into more detail on below. This will help you when deciding on which e-wallet you want to integrate into your services or e-commerce platform. It should seamlessly integrate into your software landscape. The good thing is that custom-tailored e-wallets based on a flexible software foundation are always an option.

2. Crypto Wallets

This specific form of an e-wallet stores public and private keys of a user. The keys act as certificates of ownership for cryptocurrencies, which are stored on the blockchain. To provide additional safety, so-called hardware wallets or cold wallets exist. They operate offline, typically on a USB stick.

Certain crypto wallets are also capable of processing payments with cryptocurrencies.

3. Mobile Wallets

The term “mobile wallet” is often used to refer to very different wallet applications. We also see “e-wallet”, “digital wallet” and “mobile wallet” getting thrown around as synonyms. This is not wrong as mobile wallets indeed enable digital payment, but it falls short.

As a basic functionality,mobile wallet solutions hold credit and debit card data and can be used for payment. The card data is stored on the special chip of the mobile device called secure element. The cards can exist as traditional plastic cards outside the wallet, too. Users can simply pay with their mobile wallets at points-of-sale. For this purpose, the POS interacts with the secure element of the mobile phone via Near-field Communication Technology (or in the case of older POS systems Magnetic Secure Transmission Technology).

Certain mobile wallets are able to execute payments at a point-of-sale without an internet connection. The wallet can check offline if the user has enough funds left to conduct the payment (e.g. via reading the last known prepaid balance) or it can fully skip the check, depending on the payment amount and risk scoring of the user. Once the wallet is online again, it syncs available funds and if there is not enough prepaid balance, it can e.g. automatically trigger a payment via the user’s preferred payment instrument to collect the outstanding payment amount.

Another variant of pay-by-mobile-wallet would be direct carrier billing, where the amount of the purchase is added to your mobile phone bill.

4. IoT-Based Wallets

Among the more recent variations of e-wallets count those interacting with Internet of Things technology. Those wallets sure vary: Some operate with e-money, others with virtual currencies. Some are installed in wearables such as watches, wristbands or jackets, others run on stationary wallet-enabled devices, like on your smart fridge or your smart car’s computer.

Still, we include this category to point to this rapidly evolving field. Paid services on the Internet of Things are a natural environment for e-wallet technology. Just have a look at what the automotive industry is up to at the moment.

How Digital Wallets Operate Payments

Executing payments, that is what most electronic wallets are basically there to do. B2C payments, especially on e-commerce platforms, likely present the largest field of application for e-wallets in the Western World, with mobile transactions at point-of-sales being a close second.

Aside from digital wallet systems made for the e-commerce end-user, there are solutions catering to specific businesses or industries. B2B wallets for cross-border transactions or P2P systems for value exchange lie well within the capabilities of e-wallet software.

Yet, those are special use cases. In the paragraphs below, we will look at how electronic wallets generally process payments. Doing so, we will devote ourselves to the use case of e-money-processing digital wallets specifically. Following our earlier definition, we will describe this use case along the lines of data, software and hardware.

Data Processing in E-Wallets

Data Processing is a crucial aspect for payment processing in e-wallet environments. Financial authorities place great emphasis on data security, which forces e-wallet providers to comply with various data-related regulations. Moreover, data is not only a source of challenges for companies, but also can act as a valuable resource for offering customers the best user experience.

But what do we mean when we say “data”, in the context of e-wallet?

What Types of Data Do E-wallets Hold?

In digital transactions, everything is data, so to speak. And even before a transaction can take place, e-wallet providers already inquire data from their users. For the purposes of e-wallets, we can identify two types of data. They are subject to different regulations and processes running within an e-wallet.

Digitized User Information

This category includes a broad variety of data items which usually don’t have direct monetary value. What exact data an e-wallet must store is subject to regulations in specific countries and the use case in question, but will likely include the following types of data:

- Authentication Data, including username and password

- Personal Data, like name, address and date of birth. Those are mandatory for registering an e-wallet in many countries.

- Communication Channels like email or phone number of the customer. This allows the e-wallet provider to reach out to them in case of need.

- Stored Payment Instruments, including bank account or credit card data relevant for transactions

- Historical Transaction Data, detailing past transactions for reference by the user, the e-wallet provider and financial authorities

The vast majority of e-wallets hold the data sets to some degree – and it’s necessary they do, as we will see below in our compliance and security section. Payment service providers or acquirers require some of this data to execute a payment transaction.

Digital Assets

This category refers to all data which represents monetary value. The most obvious candidate would be e-money. E-wallets, as the name suggests, can store it and use it to conduct digital payments – that is, if the wallet provider has acquired an e-money license to lawfully do so.

Aside from e-money, it’s perfectly possible for e-wallets to store other types of digital assets as well. Loyalty points, virtual currencies or vouchers make for examples here.

Data Tracking

When you have data, you can analyze it – often to great effect for digital goods and service providers. In their role as databases, payment e-wallets are tracking a user’s payment history. In fact, financial regulations even require e-wallet companies to store payment history data over an extensive period of time. Thus the system can substantiate every transaction to the user for years in hindsight.

Yet, the analysis of historical payment transactions also presents an opportunity for companies. If the data protection regulations allow it, they can query the data. This enables them to draw conclusions about purchasing behaviour of users. On the other hand, payment history tracking is an advantage for users who want to assess their spendings.

E-wallet providers aiming to include budgeting and saving functionalities also need to track their customers’ payment histories.

Compliance and Security in E-Wallet Payments

Online payments by default have an anonymous quality. Thus, users must provide their personal data when registering and setting up the wallet to identify themselves. Accordingly, this data – and also other data processed by e-wallets such as payment history recordings – deserves the label sensitive data. That means that data like this could be used to commit fraud when accessed by criminal third parties.

And not only the user is in danger of criminal activity using data stored within the wallet. The e-wallet service provider is, too: What if the user is lying about their identity or does possess unsound motifs?

There we enter the realm of Know-Your-Customer, Anti-Money Laundering and Counter-Terrorist Financing procedures. Any e-wallet service provider must feature a tightly-knit assembly of security, risk evaluation and fraud prevention, complying with the regional KYC, AML and CTF regulations. Local financial authorities pass and enforce such regulations. That means that e-wallet companies operating across borders may have various sets of rules in place for the same service, determined by the country or region. In most jurisdictions, e-wallet providers must at least undertake a number of measures.

Typical Security and Compliance Measures by E-Wallet Providers

- Customer Due Diligence: E-wallet providers run CDD checks to verify a user’s name, addresses, birth date etc. Users who might pose a higher risk are subject to Enhanced Due Diligence (EDD). Depending on the user verification level different limits apply to payment transactions and other activities.

- Transaction Monitoring: E-wallet providers scan transactions for unusual volumes and frequencies, assembling Suspicious Activity Reports (SARs) to pass on to financial supervisory authorities.

- PCI DSS: When handling credit card information, e-wallet companies have to adhere to the Payment Card Industry Data Security Standard (PCI DSS). It’s an internationally applied security standard for major card schemes.

- Strong Customer Authentication: This includes procedures such as two-factor authentication to verify the user’s evidence accurately and prevent fraud.

Those measures come with technical challenges as well. E-wallets must be constructed to integrate third-party AML and KYC, fraud prevention software where necessary. At the same time, the frontend designers and software engineers have to keep the user experience in mind, so that potential customers don’t quit due to a complicated registration process.

Payments in E-Wallets

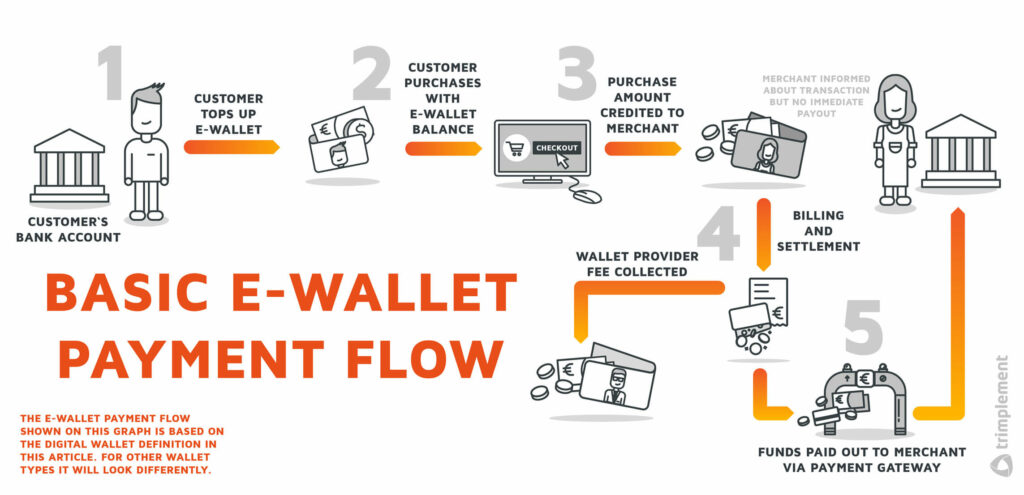

In general, purchase transactions can be paid instantly if enough funds (e-money, loyalty points) are available in the e-wallet. In addition, a payment transaction (via PSP or acquirer) can be started if the purchase amount exceeds the available balance.

Moreover, wallets exist that give you the choice how to pay: Either by your available emoney balance. Or alternatively by executing a payment transaction with one of your stored payment instruments even if you have enough funds. Certain wallets go a step further, allowing you to mix different sources for one single purchase, so that users can efficiently make use of their credit lines.

Payment Processing

A convincing selling point of e-wallets is their ability to render the payment process more convenient. Users don’t have to enter their payment details with every single merchant they transact with or for every single payment transaction. Instead, they simply need to log into the wallet with their password to authenticate a payment. This has the additional benefit that users don’t have to submit their card details on shops sites whose trustworthiness they can’t easily assess.

Certain wallets cut corners on the login process further, allowing their users to remain logged in and trigger a transaction via one-click-checkout. And they can speed up the process even more, permitting users to authorize the payment to a specific merchant or platform once and subsequent payments are executed automatically. This model often applies to subscription-based services like Netflix or Spotify.

A typical payment process where the customer is present unfolds as follows:

- The consumer would like to pay for a good or service online. They choose to pay with the e-wallet and confirm the payment. This requires them to log into their e-wallet account to authenticate the transaction, as dictated by the regulatory rulesets (i.e. PSD2).

- Whenever a purchase cannot be paid by the available balance, e-wallets can trigger the payment via Payment Service Providers integrated with the e-wallet. Thus e-wallets come with added value for merchants or marketplace platforms. For example, they allow platform providers to filter the payment methods available to the customer and then select the best route (payment method, PSP…) for the transaction, e.g. based on price or risk.

- The e-wallet and the PSP/acquirer securely exchange the financial data required to transfer the funds (personal data, payment instrument data) and set the funds in motion.

- The receiving party (i.e. the marketplace, the merchant or another consumer) is informed about the payment status. In the case of instant payment methods, the transferred funds immediately appear on the merchant’s account in the wallet. Yet, typically those funds are not directly released for usage or payout. This happens later during a settlement and billing cycle.

To sum up, in terms of payment processing, e-wallets are not so different from payment gateways (while they are in other regards, as we discussed here). Many e-wallets pull ahead of simpler digital payment applications when it comes to automation and the finer intricacies of transactions.

Refund and Payout Processing

Payment systems without e-money balances may only return money to the original payment source. This results in prolonged processes that take much work to complete (in the case of bank transfers i.e.). In some cases, the refunding is also convoluted from a logistics standpoint. Conducting refunds for cash-on-delivery transactions can cause headaches.

In an e-wallet-based system, such refunds can happen within an instant, with the platform simply releasing e-money to a customer’s wallet account. Taking the refunded money off the platform requires an extra step on part of the customer of course (withdrawing the money to a bank account). Thus, many customers spend the balance for further payments with the ewallet again – the cherry on top for platform providers and merchants.

Balance Payments for Merchants

When users pay with an e-wallet, they can use the e-money balance of the wallet instead of involving a Payment Service Provider. One specific characteristic of digital wallet solutions is however, that merchants have such a balance, too. Thus, they may spend this value in the manner of regular customers. This is a huge benefit on B2B and P2P platforms, where merchants can be buyers at the same time (e.g. eBay).

Moreover, merchants can pay the fees to marketplace platforms or wallet providers directly from their e-wallet, which usually proceeds quicker and might save some extra steps and transaction processing fees at PSPs: in this case the platform and wallet providers can get their share directly from the revenue and the merchant’s account receives the after-fee amount.

Prospect: The Future Role of E-Wallets

Given all the advantages above, it seems like a missed opportunity, that e-wallets only make up for a small share of European and American transactions. When we speak about e-wallets in the Western world we effectively mean PayPal. Thus, e-wallets are very much a market under construction: Only 21% of all transactions in the West are conducted via e-wallet, as of 2019.

So what will the technology hold for the future, in Western countries? Instead of speculating about that ominous future, we just have to turn our eyes towards Asia. This is where the e-wallet-empowered future is happening right now. More than half of all payments in China pass through digital wallet software. India and Singapore are other major adaptors of the e-wallet model.

Will the West adapt to the payment preferences of the East? Perhaps not tomorrow. But the market for e-wallet solutions is growing here, too. For Europe, it has grown by a respectable 37.3% in 2020. And it’s expected to climb up even higher, reaching approx. 91 billion EUR by 2023. And with the Internet of Things just kicking in, the demand for payment solutions for those use cases will only grow.

It’s up to you to plant the seed ahead of time.

Summary

Electronic wallets are a multi-faceted phenomenon. We can describe them by looking at their software, their hardware and the data they store and pass over to authenticate transactions.

As such, e-wallets come in many shapes, from the web to mobile wallets, from online to offline. Compared to other payment methods, e-wallets have the benefit to facilitate payment fast and with increased convenience for users.

And when it comes to business perspectives, the market is just waiting for you to get a unique solution out for your platform or application.

Expanding your platform’s or service portal’s payment system by e-wallet functionalities has many advantages. E-wallets improve customer experience, grant opportunities for data analytics and smoothen refunds, payouts and PSP onboarding.

But it’s also a challenge for companies, who don’t want to rely on standardized solutions not fitting their unique visions. Working with a highly experienced e-wallet development team and a battle-proven software framework will help you overcome all the obstacles.