Power on, it’s alive! We are excited to announce the launch of our brand-new payment orchestration platform: Finergizer. It’s a modular set of elements that allows enterprises to run their online payment landscape and scale their payment capabilities rapidly.

But Finergizer is not just any payment orchestrator: It’s here to empower your business.

As an on-premise solution, Finergizer allows you to enact full control over your customers’ payment data, and also over the operations and security measures of your payment system. Finergizer provides the jolt of energy your unique business needs to process and manage transactions – domestic and cross-border.

So, read on and get the full rundown of Finergizer and how it will make payment orchestration a breeze for your business.

Why We Created Finergizer

…and who is “we”, exactly?

We are trimplement, a leading payment software provider headquartered in Cologne, Germany. We have been operating in the fintech space for over a decade now. As you read this, payment systems created by us are busy processing transactions all over the globe on behalf of global enterprises and financial institutions like BMW, Deutsche Bank, Tide, Delivery Hero and PayU.

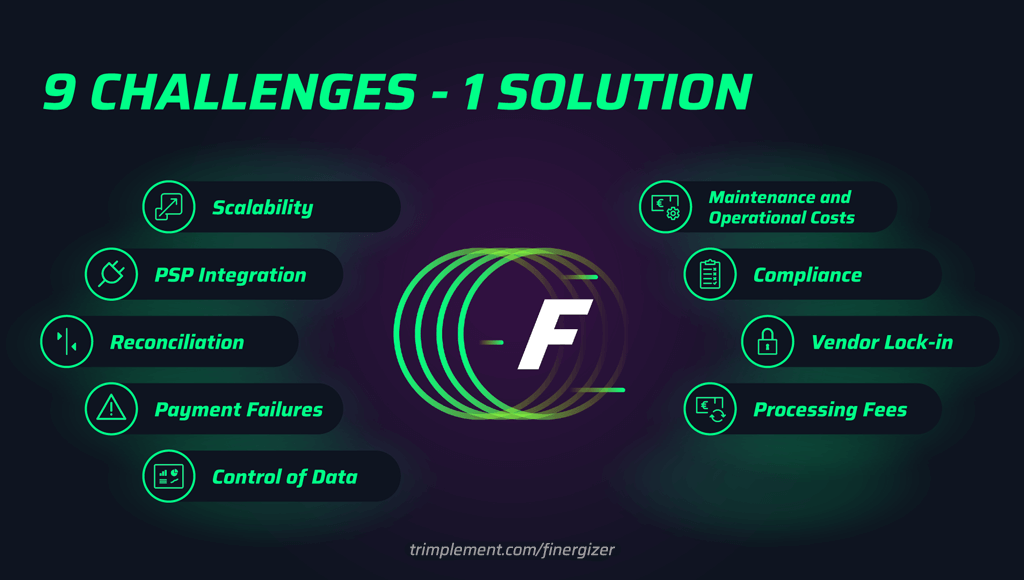

Working closely with our clients over the past years, we were confronted with many common payment-related challenges. Even as commerce moves quickly from the physical to the digital sphere and payment follows suit, we experienced that many e-commerce and online service companies still suffer from overarching problems like:

- Slow and tedious payment method integration

- Limited scalability

- Difficulty of maintaining data security and compliance

- Low performance and lack of failure safety during transaction peaks

- High transaction fees for different PSPs

- Dependence on external payment providers

- And so forth

However, we have identified that the conventional difficulties mentioned above do not constitute all the payment problem areas e-commerce businesses face. Even if it may seem like it, most enterprise clients don’t have the exact same issues. Rather, their payment challenges are fairly unique, determined by:

- The company’s size

- Their product and service palette

- The regional markets they operate in

- The local compliance rules they must adhere to

- Transaction volume and value

- Customer preferences

- Business models (e.g. subscription management, marketplaces)

- Risk of fraud

Flexible Payment Orchestration Beats Turn-Key Solutions

Turn-key payment solutions sometimes struggle to check all the requirement boxes of your business. For instance, they may not enable you to offer the most popular payment methods on a foreign market. Or they may not fit well into your overall technical infrastructure.

In addition, businesses who happen to have integrated only a single or a few payment service providers may suffer from additional dependencies and limitations. For instance, what if a single-source payment provider cannot keep up with the volume of transactions processed on a business platform. Or if its feature update priorities do not match with a company’s business strategy.

In complex payment environments, one-size-fits-all payment processing solutions cannot always act on their promises.

What Makes Finergizer Stand Out

Finergizer is not single-fit. But it’s a solution that can be fitted to your business easily. Finergizer is a modular, end-to-end payment orchestration platform you can tailor to meet your business requirements. Using a state-of-the-art microservice architecture, the platform features APIs and integration points to blend seamlessly with any e-commerce payment infrastructure.

In addition, Finergizer comes out as an already refined product. It’s the next generation of our existing, battle-proven platform CoreWallet, honed by our successes in the payment area. Our software engineers and solution architects who built the Finergizer grounded it in state-of-the-art technology. Thus, Finergizer acts as the culmination of more than 10 years of experience in planning and creating business-critical online payment software.

Who Is Finergizer For

Finergizer benefits international e-commerce and online services businesses who want to accept payments online on a global scale. Doing so the Finergizer platform is an on-premise solution. This means the system and the data become a part of your infrastructure. Thus you have full control over it and can use it in your services.

Finergizer is a flexible and reliable payment orchestration solution. It’s especially fitting for enterprises with specific challenges in payments, such as processing a high volume of transactions in different countries. Aspiring companies who want to scale quickly will benefit from Finergizer.

Overall the platform is ideal for:

- Global e-commerce enterprises who want to orchestrate payments to prevent payment failures, especially during peak times, and optimize payment flows for improved customer experience and conversion

- Online service providers who are growing fast and want to accept payments in new geographical markets but don’t want to handle many different integrations, to save operational and maintenance costs

- In general, companies who want to keep control over customers’ payment experience and their payment data

How Your Enterprise Will Benefit From Finergizer

Finergizer is designed with flexibility in mind. It consists of multiple Elements – independent modules you can license separately to assemble into an end-to-end payment platform meeting your specific requirements. Additionally, Mission Control acts as a user interface accompanying each Element.

The Finergizer Elements

Payments

Do you need a powerful system for accepting payments, managing transactions and orchestrating different payment methods? Finergizer Payments is here to do exactly that. Just by combining it with Finergizer Vault, you will be able to tokenize payment data and keep it in a tight, secure environment. In addition, the payment orchestration capabilities of Payments help you handle payment failures via failover mechanisms, and also to avoid PSP vendor lock-in.

Vault

Do you want to store credit card information in a secure environment, but still accessible for use with your services? The Vault Element provides a PCI DSS-compliance-ready card data storage. It tokenizes and protects the sensitive card payment data of your customers. What’s more, if you already have a payment processing system in place, you can seamlessly connect the Vault with it. This helps you to streamline the checkout for your customers.

Mission Control

Mission Control acts as a backoffice UI for monitoring and configuring the other Elements to your liking. With its help you can manage the payment service providers connected to your system, set up notifications and onboard facilitators and merchants easily. In addition, Mission Control acts as a terminal enabling your team to look into your payment audit logs and historical transaction records to put strategic decisions on a factual foundation.

This Element automatically comes with any combination of the other Elements.

Sample Features of Finergizer

Finergizer can do a lot if you let it. Here are a few examples:

- Capability to express various business relations (customers, merchants, payment services providers, legal entities…)

- Efficient payment orchestration

- Full payment audit log for storing historical payment data as well as monitoring and analyzing it

- Out-of-the-box integrations of Adyen, Stripe and PayPal (and more to come)

- Open-end integration layer to connect global and local payment methods

- Easily scale to any transaction volume your business requires

- Unified interface to allow building custom payment connectors

- Well-documented REST APIs

- …

Supercharge your Payments with Finergizer!

Curious how to get started with Finergizer?

You can find more information about our new, flexible payment processing and orchestration software on the Finergizer page. Our team is also eager to lend you a helping hand and guide you through the software, if you have further questions.