Digital platforms are the go-to spots for e-commerce – and terminals for countless payment transactions.

Whatever platform a customer uses (be it Amazon, Etsy, a niche marketplace for specific goods like Chewy or a “meta-marketplace” like Check24), they will have to pay for their order at some point. That’s when Payment Service Providers and Payment Gateways make their appearance. It’s their job to detect fraud and validate the purchasing agreement. And ultimately, to debit accounts and move money.

But what exactly is a marketplace payment system and what is the difference between a Payment Gateway and a Payment Service Provider? This article will provide:

- A definition of Payment Gateways in contrast to Payment Service Providers

- An overview of the parties involved in online marketplace transactions

- Next steps for building your own Payment Gateway

- Access to a Free White Paper About Payment Gateways

Let’s start.

Payment Terminology

Digital payment and e-commerce, even the internet itself are fairly young technologies, as are their corresponding industries. This means that the terminology might not be as clear and indisputable as in other fields. In fact, definition-breaking innovations are developed and made public literally as you read these lines.

Accordingly, you might find varying definitions of Payment Gateways, Payment Providers, Payment Methods, and the like around the web. Here are a few terms you will encounter throughout this article series and short definitions of them.

Payment Gateway

A payment solution authorizing and processing online payments, via one or more integrated Payment Service Providers. Refer to the section “What Is a Payment Gateway” for details.

Payment Service Provider (PSPs)

Technology providers, offering software for accepting certain payment methods like direct debit, bank transfer, PayPal, credit card, etc.

Payment Method

A specific way of paying, which requires specific payment processing. Credit card payment or direct debit would be different Payment Methods for example.

Payment Instrument

The definite personal means of payment used in a specific payment flow. For example, if you are choosing the Payment Method credit card during checkout at an online marketplace, you could pay with your Visa credit card as the Payment Instrument.

Consumers

The party using an online marketplace or e-commerce platform to obtain goods or services by paying for them. The term buyer and customer is used synonymously here.

Merchant

The party using an online marketplace or e-commerce platform to offer goods or services for consumers to purchase. The terms supplier and seller are often used as synonyms.

Now that the terms are clear, we can dive right into the details.

What Is a Payment Gateway?

In our sense, a Payment Gateway is defined as a piece of software used by online service providers, to authorize and conduct digital payments. Almost all online purchases require a Payment Gateway – from e-commerce shops, to marketplaces or to web-based service platforms.

You could picture a Payment Gateway as the digital equivalent of a physical point-of-sale in a brick-and-mortar shop. It acts as an interface between the consumer and the merchant. As such, a Payment Gateway manages payment data and passes them in both directions: It sends the Consumer’s payment data to one of the PSPs. The PSP then processes the payment, accepting or rejecting it. The amount of time this takes varies depending on the payment method.

Finally, the Payment Gateway informs both parties, Merchant and Consumer, of the payment’s success or failure.

How Do Payment Gateways and Payment Service Providers Differ?

Payment Gateways are not to be confused with Payment Service Providers. Payment Gateways authenticate and trigger the actual transaction, passing on the transactional information to Payment Service Providers. The PSP becomes active thereafter, handling the accounting, i.e. the transfer of money from one account to the other.

We have to take the plural of “Payment Service Providers” literally here. Payment Gateways generally include multiple PSPs and support multiple Payment Methods: Debit and credit card transactions, bank transfers, and even cryptocurrency payments. In addition, many marketplaces settle for Payment Gateways supporting local payment methods of choice. Take Ali-Pay and WeChat Pay in China, e-cheques in the US, Sofortüberweisung in Germany or Boleto Bancario in Brazil.

All in all, we can understand Payment Gateways as a Payment Service Provider Orchestration Layer. They typically have a routing logic to choose the best Payment Service Provider for the given payment flow based on criteria like country, merchant category code, verification level and risk level of the consumer, transaction costs and so on.

Who is Involved in a Marketplace Payment?

The exact number of parties and the nature of their connections depends on the payment method used during the checkout.

One thing is certain, though: On digital marketplaces, consumer accounts and merchant accounts are not the only parties involved and connected through the Payment Gateway. Most often selling parties and platform operators don’t coincide.

Thus, some Payment Gateways incorporate a usage fee that merchants have to pay to a third party, the marketplace owner, just when the transaction takes place. For credit card payments, you may have additional parties between the merchant and the customer, such as Acquirer and Card Scheme Provider. And then, maybe you don’t pay with FIAT currencies at all – in case of cryptocurrency payments the players involved would be quite different.

Whatever the lineup, Payment Gateways connect all those parties as the payment-authorizing technology.

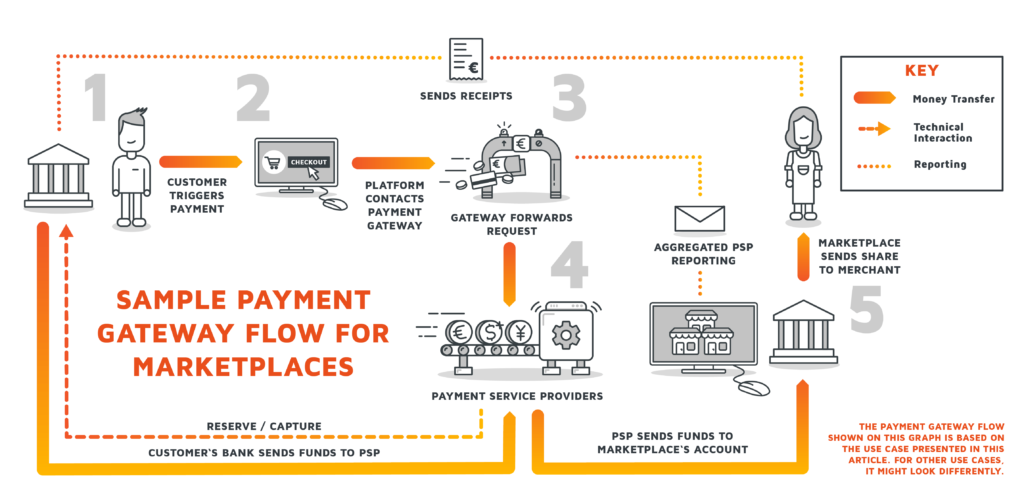

But let’s look at an example here. These are the parties, who would be part of a Payment Transaction, in which the consumer settles the bill via a bank transfer.

Involved Parties in Marketplace Payment Transactions

| The Consumer Account The party making the purchase, actively triggering the payment during checkout. They receive the product or service in exchange for money. | The Consumer’s Bank The bank holding the Consumer’s funds. The bank account which will send the funds to the receiving bank (typically the bank of a PSP) after the consumer has triggered the payment. |

| The Merchant Account The party offering the product or service on the marketplace platform in exchange for payment. Usually, merchants are required to pay fees to the marketplace owner. | The Merchant’s Bank The bank receiving the consumer payment via the Payment Gateway. |

| The Marketplace Owner The party providing the marketplace platform for merchants to present their products and services on. The marketplace owner might charge merchants with fees for using the marketplace. | The Marketplace Bank The bank receiving the fee paid by the merchant for using the marketplace. The Payment Gateway might subtract the fee automatically during consumer-to-merchant payments |

Also mind that multi-vendor transactions on marketplaces are common. Consumer’s baskets may contain multiple goods and services from different stores, and thus processing a single payment on the Consumer’s side will include handling the settlement of several merchants and merchant banks.

Next Steps: Building Your Own Payment Gateway

A high number of PSPs aimed at single-merchant online stores struggle with the challenges posed by the platform economy.

First off, digital marketplaces have a much broader scope than single e-commerce shops. They not only have to deal with multiple customers but also with multiple merchants. Therefore Payment Solutions are not only a potential point of failure in the relation buyer ↔ marketplace. They also have the potential to jeopardize the relation seller/supplier ↔ marketplace.

Also, the regulatory and contractual requirements prove different than those of isolated online shops.

The Central Question: Build or Buy

As the owner of an online marketplace platform, choosing the right Payment Service Provider for your distinct business model boils down to a fundamental decision: Will you settle for an External or rather a Self-Hosted Gateway? It’s the notorious choice between Buy or Build.

External Payment Gateways are the Buy option. Such Gateways are offered by third-party providers and can be used in exchange for fees. And as they are hosted offsite, the provider in question takes full responsibility for data security, KYC procedures, and PCI DSS compliance.

Self-Hosted or simply Self-Built Payment Gateways are exactly that: Payment Gateways you Build in-house by your own software engineers or by an external partner development company. If you decide to go for this solution, you have to run your Payment Gateway on your own servers, for the benefit of having full control over the functionality and usability of the software.

So will you settle for the Build or the Buy option? Download our free White Paper to learn more about Payment Gateways (and how to decide whether build or buy is the better option for you).