What a year… good thing, we have a new one in replacement.

Last December, when putting together our annual industry recap articles (you can find some of them here if you are in for nostalgia), we could not have guessed that the fintech scene would be on the brink of profound change. Many predictions, fintech and banking experts had made for 2020, did not occur – or did not occur for the reasons that we assumed would provoke them.

Everything considered, though, the financial industry got off cheaply in 2020, when compared to other industries. Some branches could even step up their game.

The question now is, if the fintech trends of 2020 will continue in 2021 or if they will “return to form”, once the restrictions in worldwide trade, business and retail loosen again. A look in the rear-view mirror will give us some implications.

The Corona Pandemic and Its Impact on the Fintech Industry

You knew it wouldn’t be long before we would call the disturber by its name. The SARS-CoV-2 pandemic has been the elephant in Room 2020. The illness itself might not have affected everyone. But its impact on society and the economy a whole is substantial. It’s fair to say that everyone suffered from the pandemic in one way or another.

One effect of the pandemic, incisive for the fintech industry, was the restriction of mobility. By that, we do not only refer to physical mobility. Financial mobility was also impaired as many people faced unforeseen costs or feared their sources of income would dry up. All over the globe, at different intervals, the pandemic confined people to their homes. Accordingly, remote working routines caught on with CEOs. Companies that were not already well-equipped digitally struggled to get their networks secure and establish communication procedures.

For fintech providers, a view on spending habits in the population can act as an indicator for their own prospects. Threatened by economic uncertainty, many became more conservative spenders regarding big-ticket items. Likewise, investors hesitated. In 2020, fintech funding swerved through a period of many ups and downs, with the number of deals plummeting in the first half of the year. In the third quarter, a few mega-rounds passed, but the overall deal activity remained low. This turned into a problem for up-and-coming fintech companies in particular. Many cashed in less than they would possibly have in years prior. Overall, the corona pandemic somewhat slowed down the trend of expanding fintech funding.

Shifts in Payments

As always with a global crisis, it’s „win some, lose some“. In 2020, we could count online shopping among the winners. For example, Amazon saw a 37% earnings increase in the third quarter alone. And as every online shopping trip culminates in a checkout page, online payment solutions benefitted from huge increases last year. Good news for payment service and wallet technology providers.

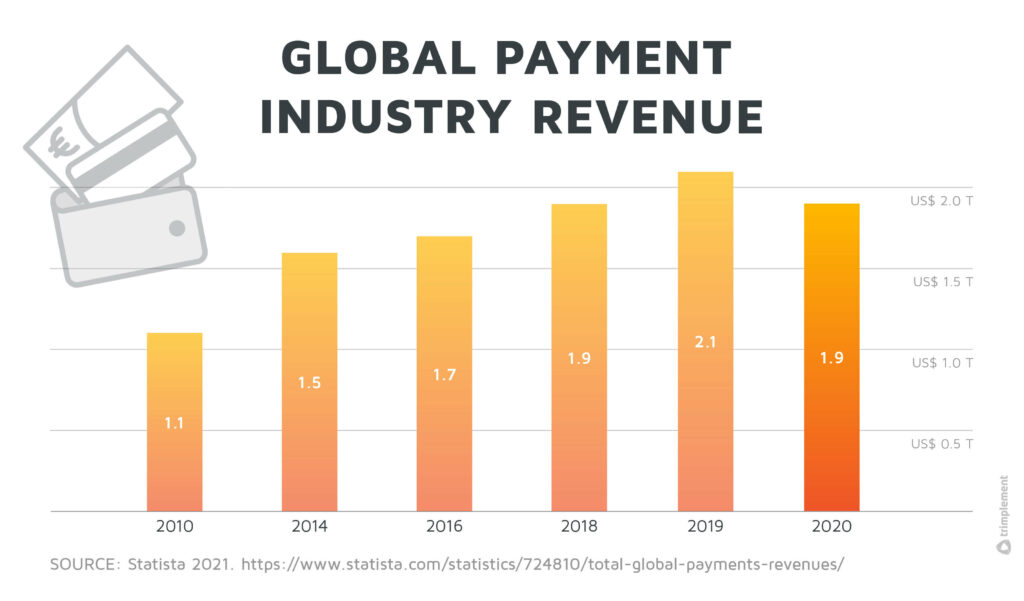

Notwithstanding these gains, though, the overall payments sector has experienced setbacks as well. The annual McKinsey report1 states that global revenues actually declined in the payments sector for the first six months of 2020, when compared to the same period in 2019. They also expect payments revenues to be about $140 billion lower than one year ago. Especially point-of-sale payments providers and loyalty businesses have felt the decline. Moreover, while online e-commerce thrived, other sectors of cross-border trade and cross-border payments fell back.

Cashless Is King

We chose to use the term „shift“ over „setback” when describing the impact of the SARS-CoV-2 virus on the financial industry. After all, as expected in 2019, we saw a continuing growth of cashless payments solutions.

Of course, this growth did not occur for the reasons assumed. Not the rapidness or convenience encouraged customers and businesses to adopt card- and mobile-based ways of payments. Instead, they did it out of pure necessity in the face of health rules in commercial environments and extensive stay-at-home periods. Payments did adapt to the new situation and it will not simply rollback, even in more cash-centric societies.

In fact, cash usage dropped by up to 30% in cash-inclined countries like Italy, Japan or Germany during 2020, as customers migrated to contactless or online payments.2 In other parts of the world, where other payment methods already contested cash, the decline was even sharper.

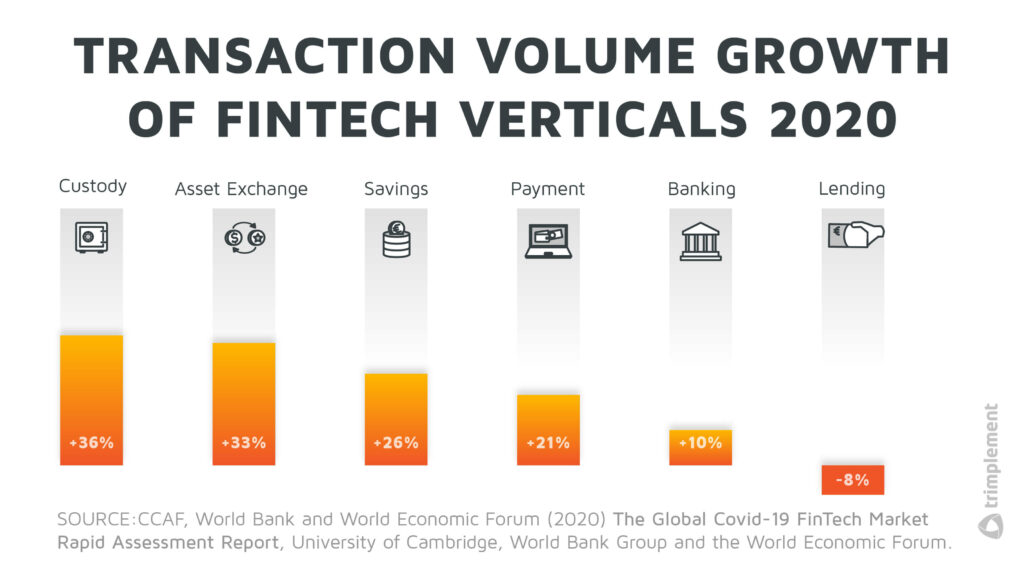

Overall, the transaction volume of digital payments did increase worldwide in 2020 – in all areas except digital lending.

Security Threats for Fintechs

With the growth trends pointing upwards for fintech in 2020, the industry also saw growing operational challenges. The increase in traffic exposed the fintech infrastructure to an unforeseen stress test. But it’s the security framework that caused more worries. Cybersecurity risks have been identified as one of the main problems to address for fintech providers. Four in five regulators fear that digital security threats due will continue to rise during the pandemic. According to a report of the World Economic Forum, the response is measured: 28% of the surveyed fintechs have stated their intent to upgrade their fraud and cyber-attack defences.

But it’s not only on part of the companies to counter this development. Half of the companies asked in 2020’s Global COVID-19 Fintech Market Rapid Assessment Study3 point at regulators, too. They feel the need for more regulatory support during the Corona crisis, e.g. with new product approval or remote onboarding, especially in areas with expansive lockdowns.

The State of Banking in 2020

Many of the trends in the fintech industry and the payments sector in 2020 also apply to the banking sector. At the current state, digital banking did only register a moderate increase in 2020. In their end-of-year review, KPMG does not write off the industry. Rather they attest that a „positive discontinuity“ might kick in and fuel adaption in the bank sector. Following that thesis, the pandemic-induced banking crisis will act as a wake-up call for banks to rethink finance. Green lending or a move towards well-rounded open banking APIs are just two examples here.

But we are talking about the long-term perspective here. In short regard, 2020 continued some trends abounding in the banking industry before. For example, the former competition between fintech challengers and incumbents slowly morphs into a cooperation, pulling together against the growing power of BigTech finance like Google, Alibaba or Apple.

Europe – Pushing for Standardization

Yet, in Europe, banks are still reluctant to leave their comfort zone in this regard. In comparison to other parts of the world, open banking is not picking up pace in the EU, except regulatory initiatives to instil movement.

Germany is one of the worst offenders here. Just before Christmas, the BaFin has granted German banks an extended transition phase for implementing the Payment Service Directive 2 regulations for online credit card payments. The reason: The banking houses were not yet ready to comply. A PSD2 soft launch, by all accounts.

The aforementioned pandemic-related developments affected most countries to some extent. Yet, the various parts of the world saw different financial trends in 2020, affecting enterprises and governmental initiatives. European regulators, fintechs and banks don’t want to be left behind on the international market due to a fragmented payments landscape. On their way to unification, however, they move at vastly different speeds.

And yet, progress has been made in 2020. Building on the SEPA Instant Credit Transfer Scheme (SCT Inst) as a foundation, 16 EU member states drove the goal of a holistic European Payment system forward. They formed the European Payments Initiative or EPI. It aims to create an EU-wide Credit Card Scheme and bring a Digital Wallet for the retail market on the way, among other plans.

A Year of Crypto Adoption and Regulation

In 2020, we saw an increased effort to edging decentralized financial systems closer to the payment mainstream, doing away with its anarchistic potential. It boils down to one concept: Establishing rules. All around the globe, governments worked to close regulatory gaps for cryptoassets. Among regulators, the proposal of the European Commission already caught some attention. Called MiCA (Regulation on Markets in Crypto-Assets), it aims to replace the national regulations of member states and is very encompassing regarding which cryptoassets it applies to. Indeed, MiCA has the potential to act as a blueprint for similar regulatory rulesets in other countries, once it’s fully in effect.

Aside from that, we can see a growing acceptance of blockchain technology as a whole. As Deloitte points out, it leaves the status of an “experiment”. Their 2020 survey indicates that 55% of business leaders see blockchain adoption as a key priority.

This has implications for the acceptance of cryptocurrencies as well. Over the course of 2020, the value of the crypto market grew dramatically – early this year, it even passed the $1 trillion mark. Bitcoin came out as the big winner, as of the publishing date of this article, the Bitcoin price has quadrupled to well over $28000.

And with PayPal having announced support of various cryptocurrencies as early as the first quarter of 2021, cryptocurrency payments might soon become a force to reckon with, for all financial institutions.

2021 – What’s Up And Coming?

Forecasts about the financial landscape of 2021 have become more difficult due to the unknown variable called SARS-CoV-2. However, we can provide some estimations and a little food for thought.

Dipping Revenue…

With the state of the world as is, payment businesses might want to brace themselves for a period of slower revenue growth. The Boston Consulting Group suspects global payment revenue growth to settle down between 1% and 4% in the near term. That’s about half the rate of the years following 2014. Especially businesses, which have not yet fully embraced digitization will have a hard time to compete.

…But Growing Appeal

On the other hand, the pandemic has raised awareness of the opportunities of digital payments, especially on the customer side. In Europe, shopping behaviour might move away from country-based differences, as digital affinity will become a more important factor. That means that shopping preferences will be determined more along the lines of age groups. As an overall tendency, the adoption of contactless payments (cards or e-wallets) will likely benefit from this development. However, revolving credit cards might face a harder time.

That won’t keep credit card companies from pushing into their markets, though. In Germany, the drugstore chain “dm” just established a cashback system in cooperation with Mastercard.

The Rise of Omnichannel

With all the back and forth of being locked down and opened up, it will become harder for businesses to maintain a clear distinction between their point-of-sale payments and their online payment environments. As with mobile wallets like ApplePay, this distinction is already a thing of the past. It stands to reason though that omnichannel payments will take root in the mainstream over the next years.

Sustainable Finance

In the press, environmental concerns and the battle against climate change are already headline material, as well as in daily politics. It was only a matter of time before green policies would seek application in the financial industry. The EU has already put a sustainable finance strategy into motion. 2021 might well go down as the year some larger steps towards a climate-neutral future were taken – at least in the financial industry.

Open Season for Open Banking

Even with all the drawbacks the pandemic brought, we can renew our claim from years prior: Open Banking will continue to spread and put pressure on the traditional banking industry. The EU still has its work cut out, pushing banks to adopt PSD2 with all consequences. But as it’s very active in reviewing the European financial landscape, we can hope it will put its foot down for once.

Fintech Industry Trends in 2020: The Conclusion

Wrapping it up, 2020 has been a decisive year for fintech. It showed that the demand for digital finance solutions is high, even in cash-loving countries. Coping with the increasing demand, the fintech industry made the point that its alleged flexibility and adaptability are more than marketing lingo.

The question now is, if these trends will continue into the new year. We should not forget that right now the pandemic still remains a driving force in international politics, market development and customer decisions. Whatever will happen in 2021, it will take us a while to chase that elephant off the room again. Let’s hope it will toddle off without much fanfare.

Our promise for the new year will be that we will continue to code the future of e-money – with all levers set to flexibility, quality and a short time to market.

But did you know that 2021 will be a special year for trimplement, too? We have just entered our 11th year. And since 11 is a special number in our hometown of Cologne, Germany, we decided to celebrate this anniversary in style. For starters, why not get to know us a bit better? You can do so over here, on our team page!

References and Further Reading

1 The 2020 McKinsey Global Payments Report by McKinsey & Company (2020)

2 Global Payments 2020 by Boston Consulting Group (2020)

3 The Global Covid-19 FinTech

Market Rapid Assessment Study by CCAF, World Bank and World Economic Forum (2020)