E-money, short for Electronic Money, is the electronic alternative to cash. Since it started as a concept in the 1980s and rose to prominence during the Dot-Com era, it has acted as one of the biggest game-changers in the financial industry. In a matter of only four years, from 2014 to 2018, the number of electronic money transactions in Europe alone doubled to more than 4 billion.

This aspiring form of money deserves our attention. To provide a starting point, this article will give an overview of:

- The definition of e-money as a whole

- The subtle distinctions in its applications

- The process of electronic payment with e-money

- The potential downsides of e-money

- And finally, e-money licencing and who should apply for such a license

Let’s start!

So, What Is E-money?

E-money is defined as a digital, monetary medium of exchange that is represented on an electronic device. The device in question could be software (like a banking system, or a payment service provider such as PayPal) or a piece of hardware like a smartphone or a magnetic device such as a prepaid card. In both cases, we call such devices storing e-money electronic wallets or e-wallets (check this article for a full explanation of those).

That’s just the basic definition, of course. The official definition comes with a few more layers of meaning, which set electronic money apart from other forms of digital and manifest value.

The Definition of the EMD

In the EU, all handling of fiat-backed electronic money – from payment to obtaining an e-money license to supervising e-money institutions – falls under the purview of the EMD (Electronic Money Directive). This directive was put in place by the European Commission to create a cohesive rulebook for electronic money, including practices for security, risk-aversion, licensing and onboarding of new companies willing to position themselves on the electronic money market.

In 2009, the Commission brought a revised version of this directive into force, now referred to as the EMD2. It contains the following definition of e-money:

“electronically, including magnetically, stored monetary value as represented by a claim on the issuer which is issued on receipt of funds for the purpose of making payment transactions […], and which is accepted by a natural or legal person other than the electronic money issuer“

European Central Bank 2020, Electronic Money, accessed 23 October 2020,

Let’s look at it in more detail.

E-money, following this definition, is a stored value which generates a claim once it is issued. So, like all money in our centralized financial system, electronic money maintains its value through trust. In the case of e-money, this trust is backed by stable, well-accepted assets. The issuer only gives out e-money “on the receipt of funds”. This means that all electronic money in circulation derives from fiat money. This makes it more likely for said “natural and legal persons” to accept e-money payments.

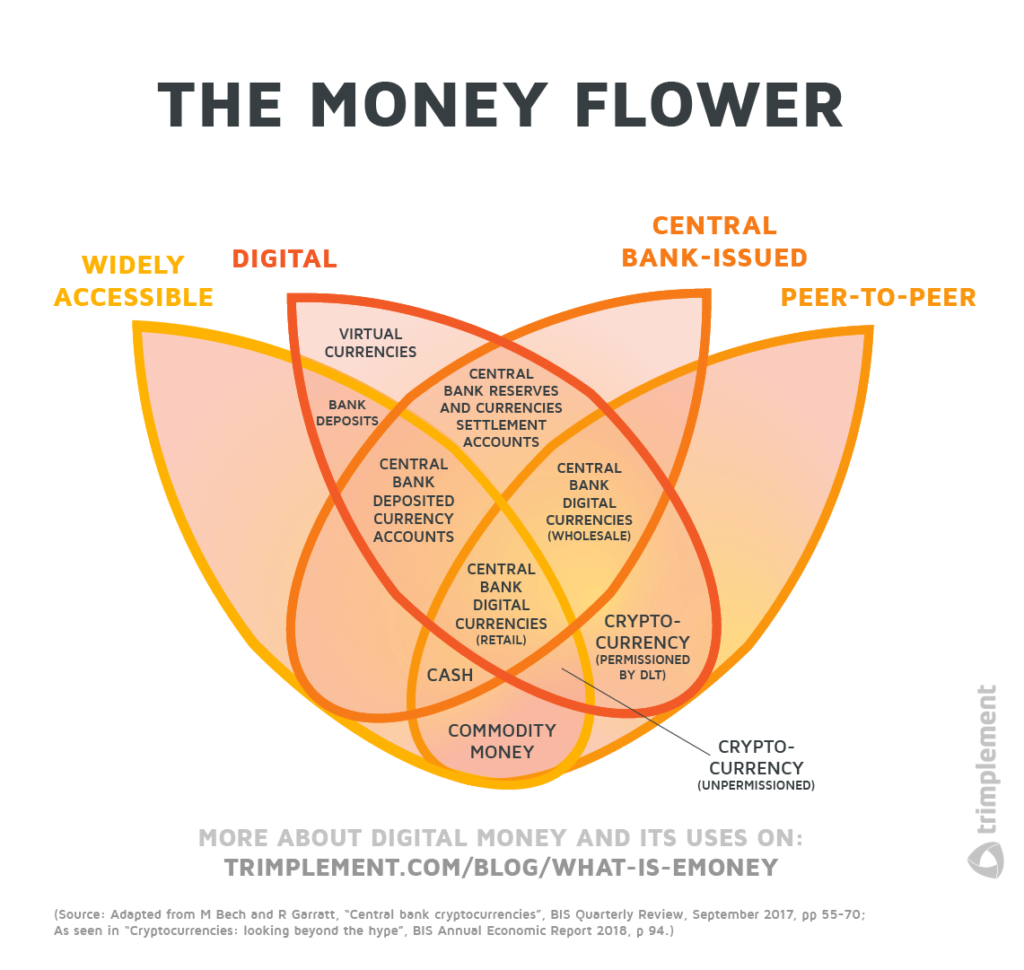

The Difference Between Electronic Money and Other Digital Currencies

Electronic money, as represented by the digital values stored and transferred online, is an e-currency. Yet, those two terms cannot be used synonymously. The label e-currency also applies to cryptocurrencies, specific tokens like ICOs or virtual currencies like video game monetization currencies. All these unique variations of digital currency have qualities and applications that differentiate them from e-money.

Cryptocurrencies vs. E-Money

Take cryptocurrencies, for example. Like electronic money, they have a worth which can change with the ebb and flow of the market. There are also goods and service providers who accept them as payment.

But that’s where the similarities end. In opposition to electronic money, cryptocurrencies are not governed by a centralized authority. In “classic” electronic money transactions you have a financial institution acting as an intermediary supervising it. E-money institutions must comply with anti-money laundering, anti-fraud and know-your-customer regulations or face legal consequences. Cryptocurrencies, as a relatively new technology, are not yet widely regulated. A decentralized complex peer system validates and processes crypto transactions.

Furthermore, classic cryptocurrencies are not backed by fiat money. Thus in contrast to e-money, whose fluctuation in value is tied to the assigned fiat currency’s value. Cryptocurrency’s worth is fluctuating, as determined by supply, demand and developments of the crypto market.

Stablecoins vs. E-Money

A relatively new form of cryptocurrency – Stablecoins – throws a bridge to electronic money. A stablecoin’s value is indeed backed by one or multiple assets, some of which can be fiat currencies. Those stablecoins combine the solidity of fiat-mirroring e-money with the decentralized distribution of cryptocurrencies.

Virtual Currencies vs. E-Money

Strictly speaking, virtual currencies are more stable in worth than many cryptocurrencies. Private companies play the role of issuers here instead of governments. One example of this type of currency is the tokens used as in-game currencies in video game monetization. They have a specific value and players can only spend them on content within the game’s environment. But while such virtual currencies cost money (and for popular games have been the subject of speculation in the past), they are not e-money.

Again, a look at the European Commission’s definition will lighten up the matter. The regulation states that virtual currencies are:

“a type of unregulated, digital money, which is issued and usually controlled by its developers, and used and accepted among the members of a specific virtual community”

European Central Bank 2012, “Virtual Currency Schemes October 2012”, p. 2, accessed 23 October 2020

We might want to add an “only” to the end of that sentence. Virtual currencies are not backed by fiat money and not held to the same regulatory standards. They can only act as a means of payment within a specific environment, like a game or an online shop. As long as one cannot exchange these virtual currencies back to fiat currency, they don’t fall under e-money regulations (see the redemption criterion below). Overall, virtual currencies and electronic money have many shared characteristics, yet the former are much more restricted in their use. This is why companies dealing in them don’t need an e-money license.

How can E-Money be Used?

The rulebook detailed in the EMD2 makes it clear that e-money must be redeemable. Thus, it can find use in transactional ways similar to that of cash. E-money can act as payment for goods and services as long as their providers accept electronic payments.

At this point, we must make a distinction between two forms of electronic money usage: Those of software-based e-money products and hardware-based e-money products.

Software-based e-money products would perhaps appear to be the “standard” e-money use case these days. Taking this form, our electronic money is stored and transferred digitally via software that runs on personal computers, tablets or smartphones. Via such emoney, we can conduct our electronic payment (or e-payment), using an e-wallet provider (such as PayPal). Naturally, all this requires an online connection with a remote server.

Hardware-based e-money products don’t necessarily need online connections. Instead, the monetary value rests on a physical device called a hardware wallet (i.e. a chip card or a prepaid app on a mobile phone). Top-up and withdrawal typically proceed via a special device reader, while payment typically occurs at a specific physical point-of-sale.

In any case, however, e-money transactions, hardware-based as well as software-based, don’t have to involve banks to conduct the payment, as long as it’s a certified e-money institution conducting the service in question.

What are the Benefits of E-Money?

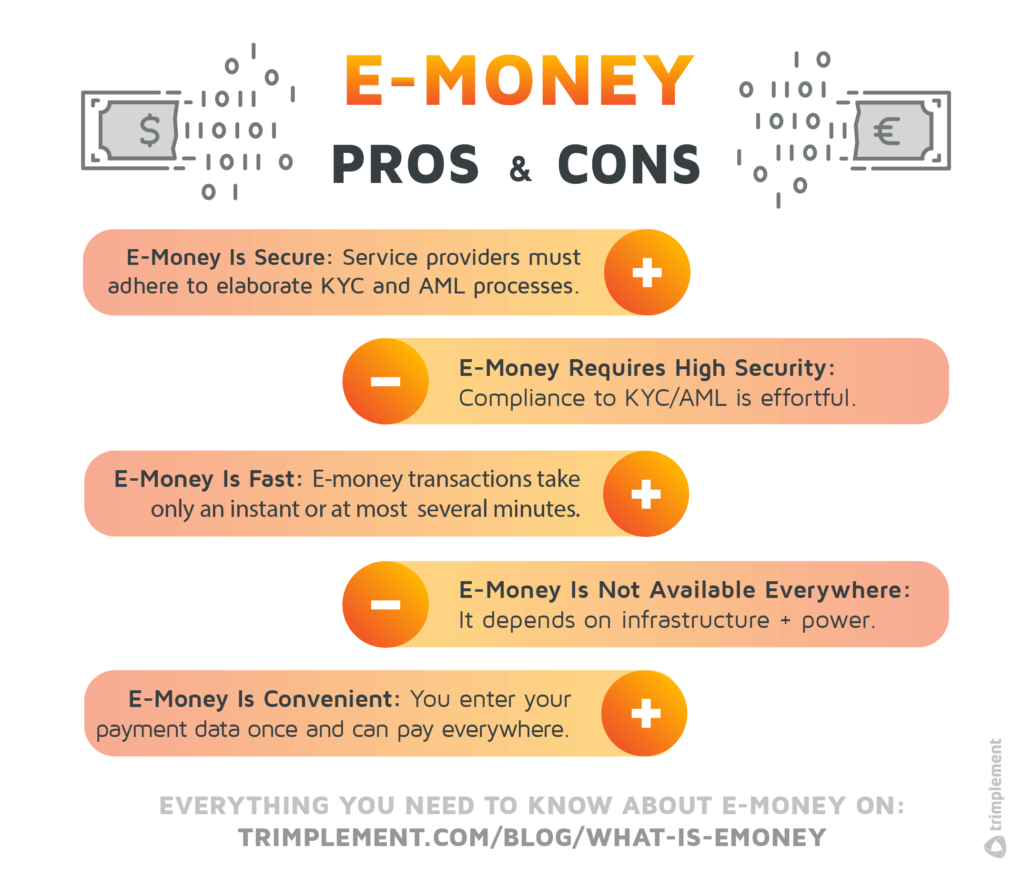

In our digital age, e-money has greatly diminished the role of cash – in some countries, it might even replace it entirely, at some point in the future. The cause behind this shift lies in the many beneficial qualities e-money has, for companies, financial institutions and customers alike. A selection:

1. Security

Many experts rate e-money as more secure than cash. You can’t misplace it or give more due to a calculation error at the counter. And criminals can’t steal it so easily, too.

Encryption technology, customer authentication technologies (like multi-factor authentication) and regulatory standards make sure that electronic money also remains secure on the web. To prevent theft of identity and other cybercrimes regarding your e-money wallet, service providers are also obliged to KYC, anti-fraud, anti-risk and AML compliance.

2. Convenience

Paying online has become the domain of electronic money– and it has for good reasons. Choosing prepayment via bank transfer as the payment method for online shopping ends in trips to banking branches or your bank’s often convoluted online banking platform.

When you choose a direct debit or credit/debit card as a payment method online, you have to enter the credentials of your credit card or your bank account data every time when paying online.

E-money service providers offer e-wallets in which you can store your payment instrument data. For payment on an online platform, you simply choose your e-wallet as the payment option and buy with just 1 click. It’s literally like opening your wallet and handing over cash, except digitally.

3. Fast Transactions

The third quality speaking in favour of e-money is its transaction speed. Electronic money transactions at points-of-sale or in an online shop take place instantly. Online transfers between the payers’ and the payees’ accounts proceed considerably quicker than those via wire transfer – they are a matter of minutes rather than several days.

What are the Disadvantages of E-Money?

All benefits aside, electronic money has its own risks and drawbacks other forms of money such as cash do not suffer from as strongly.

1. High Security Requirments

Electronic money’s high level of security comes with a downside – it involves more effort to uphold for e-wallet providers. Electronic money doesn’t so much change hands as it changes accounts. When you pay online with it, you don’t have to be present – but your e-money payment provider still needs to adhere to security schemes. Thus, adhering to the KYC and due diligence processes required by PSD2 falls to the service providers, with all costs and efforts. The same is true for anti-fraud and anti-money-laundering procedures. And finally, depending on the value of a transaction, companies may ask their customers to provide additional identificatory data, like utility bills, ID card copies or personal identification verification during video calls.

2. Not Always Readily Available

Whether or not you have access to e-money payment services is not only a matter of infrastructure, it’s also a matter of opportunity. Electricity to process e-money transactions is a given in most countries. However, EMI outages are, e. g. due to bugs or political influence, a risk in any case. Also, when it comes to internet connections or the availability of e-money-accepting online services or physical points-of-sale, the coverage can be less certain, depending on the country. And finally, you are dependent on the merchant in question – merchants must have integrated the customer’s e-wallet provider. For example, electronic money issued by PayPal can’t be used at merchants who have only helloPay integrated.

What is an E-Money License?

We have mentioned them several times above: E-money licenses. Why are those so important?

As we discussed, electronic money is governed by financial authorities and backed by fiat money. As such, most electronic money issuing falls in the domain of businesses – as opposed to banks who may issue e-money by virtue of their full banking licenses.

Yet, the new challengers have long since arrived. Some e-wallets, like Paypal, Apple Pay or WeChat Pay now dominate a large share of the market. But in the late 2010s, the EU decided to open the payment market more. Their second Payment Service Directive (PSD2) forces banks to provide APIs for payment companies, financial service providers and fintech startups and share customer data with them, should customers give their approval.

However, if a payment or financial service company wants to issue electronic money as part of its offers, it may have to apply for a special E-Money License, as laid down e.g. in the European E-Money Directive (EMD 2015/2366). The positive: While different EU countries field their own procedures to obtain such a license – in Germany, the ZAG §11 applies – obtaining one in any country will allow you to do business across the whole of the EEA. This practice is also known as “passporting”.

Upon receiving an E-Money License, a company becomes what’s called an authorized E-Money Institution (EMI), instead of a mere Payment Institution. But what’s the difference?

Payment Institutions vs. Emoney Institutions

Payment institutions (PIs) as defined in the PDS2 Directive are licensed to do the following:

- Conduct payment transactions, including credit transfers, direct debits and e-money payments via EMIs (PayPal, etc.)

- Issue or acquire payment instruments

- Execute money remittances

- Offer foreign exchange services and similar services

Now, if Payment Institutions may process electronic payments, why bother with becoming a fully-fledged E-Money Institute? As a PSP and financial service provider who aims to offer a broader spectrum of services, like the following ones, there is no way around it. EMIs have the authorization to do all of the above, with the addition of the following:

- Issue and store e-money

- Offer electronic money payment instruments (such as payment cards or hardware e-wallets)

In surplus, they have a lot more leeway when it comes to e-money payment than PIs have. For example, electronic money processed by Payment Institutions may only be used for a predefined purpose and must be refunded to the source of payment (credit card or bank account). Moreover, they may not keep the e-money balances of their customers. In comparison, EMIs may store electronic money as long as needed. EMIs can allow their customers to withdraw their electronic money, turn it into cash or send it to other bank accounts. They can keep refund money in the system.

However, the regulatory ruleset of the European Commission demands that e-money institutions have an amount equal to the issued e-money on deposit – as opposed to banking institutions, who could put a significant part of their customer’s money to work.

So, if your business model revolves around any of such services, you should apply for an e-money license. Some countries even give the option of obtaining a Small E-Money License which allows companies to issue electronic money, but only in some exceptional cases.

Please note, that access to electronic payment services has developed into a key factor of economic growth in many developing countries. E-Wallets are also a big opportunity for unbanked people to achieve financial independence. Thus, in many countries, e-money licenses are in high demand. For example, the following fintech and big tech businesses have applied for such a licence for the EEA region during the past years:

| Company | E-Money License in… | Acquired in… |

| Alipay | Luxembourg | 2019 |

| Amazon | Luxembourg | 2010 |

| Ireland | 2016 | |

| Lithuania | 2018 | |

| Mercedes pay S.A. | Luxembourg | 2012 |

| Uber | Netherlands | Pending |

| Volkswagen Payments SA | Luxembourg | 2017 |

| Zalando | Germany | 2019 |

E-money adoption accelerates in developed nations as well. Some states even go further and plan to introduce a digital version of their national currencies like Sweden with its E-Krona.

Conclusion – or: Getting Into E-Money

Taking everything into account, electronic money has become a staple of payment and the international financial industry, especially in countries with dynamic fintech markets like China or Singapore. E-money is convenient, secure and impresses with rapid transaction speed. But most importantly perhaps, it is intuitive to handle.

In fact, applying for an e-money licence is no longer the sole domain of payment companies: The platform economy has discovered the advantages of electronic funds, too, and wants to participate. Inventive companies like e-tailers, marketplace platforms or service providers (i.e. automotive companies) obtain e-money licenses to present their customers with worthwhile new features.

In any case, even if you are not a payment provider, make sure to keep an eye on electronic money.