Tough Times for Fintech

After 2 years of Covid-19 pandemic, just when we thought that the hard times were nearly over, reality hit us in February 2022 with the war in the heart of Europe. We don’t yet know what the long-term consequences of the global economic situation will look like, but we already see the impact in different areas of our lives and businesses in the EU. Many countries take care of refugees from Ukraine, support the attacked country with weapons and ammunition, impose sanctions against the aggressor and bear the consequences of these sanctions suffering under the high dependency on Russian gas and oil. The population is struck with high inflation and rapidly increasing prices. Many small businesses struggle to keep their heads above water due to growing energy costs. Startups in different areas experience venture capital funding curbs and shrinking valuation. And fintech is affected by these negative developments, too.

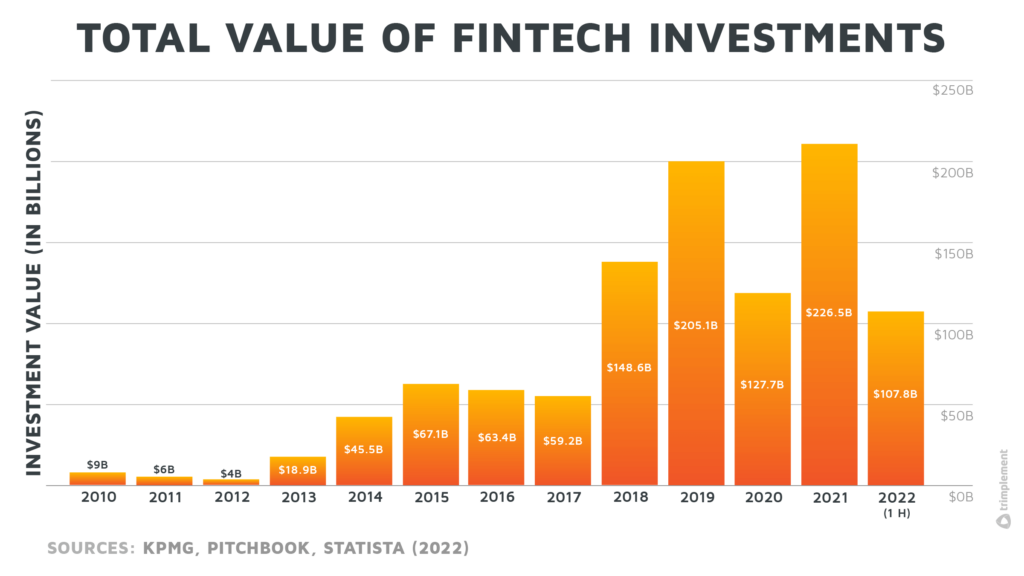

After the record year 2021, in 2022 the investments into fintech worldwide dropped from 226,5 billion USD to 107.8 billion USD. And it’s unlikely that the second half of the year will be as good as the first one. Most likely the deals that were closed in the first half of 2022 were negotiated at the end of 2021 / early beginning of 2022. That means, before the war in Europe and the recession started, under totally different circumstances.

A report by Andreessen Horowitz shows that fintech companies valuations have fallen from 25 times forward revenue in October 2021 to four times forward revenue in May 2022.

Read More