Returns and refunds are a major concern for retailers. One important factor is cost. In 2021 alone, the combined value of all returns in the U.S. was $761 billion. What’s more, The fees that merchants have to pay to payment providers for refunds to the original source of payment add to this amount. Building their own e-wallet-based payment system can reduce these costs while improving the customer experience. But how to build an efficient refund processing for e-commerce platforms – that’s what we want to answer in this article.

In the following paragraphs, we will take a look at:

- The difference between returns and refunds

- The typical flow of a refund in online retail

- The challenges of refunding payments

- The advantages of an e-wallet system for refunding

- The process of building one yourself

And: action!

What Happens During an Online Retail Refund

The typical case for an online retail refund is that the customer gets the money they paid for a good or service back from the merchant. The initiative behind this usually comes from the customer. They can trigger a return of the goods on the shopping platform – on today’s platforms, usually without giving any reasons.

But that’s not the only case, in which a refund would be due. Refunds can also be initiated if:

- The goods are lost or the package was damaged

- Duplicate payment: the customer paid the same items multiple times by accident

- The wrong price was charged

Thus, returns and refunds are not equivalent. Returning an item leads to a refund if the customer has paid for the goods in advance. But some returns do not have to end in a refund. This is the case for operations where customers receive the goods before they have even paid for them, like Try Before You Buy.

The exact process of a refund depends on several factors, such as:

- The products or services received, as some are impossible to return and refund

- The time window during which refunds may be requested

- The presence of merchant fees or shipping costs for customers

- The original source of payment used at the time of purchase.

In many places, however, the payment technology used is the decisive factor. For example, the process for refunds to the original payment source is different from that for refunds to an on-platform customer account. Refunds to credit cards are particularly challenging.

The rules for returns and refunds are defined in the retailer’s return policies. As a rule, products can only be returned and refunded within a certain time window. In addition, some e-commerce platforms charge customers a shipping fee for returning the item.

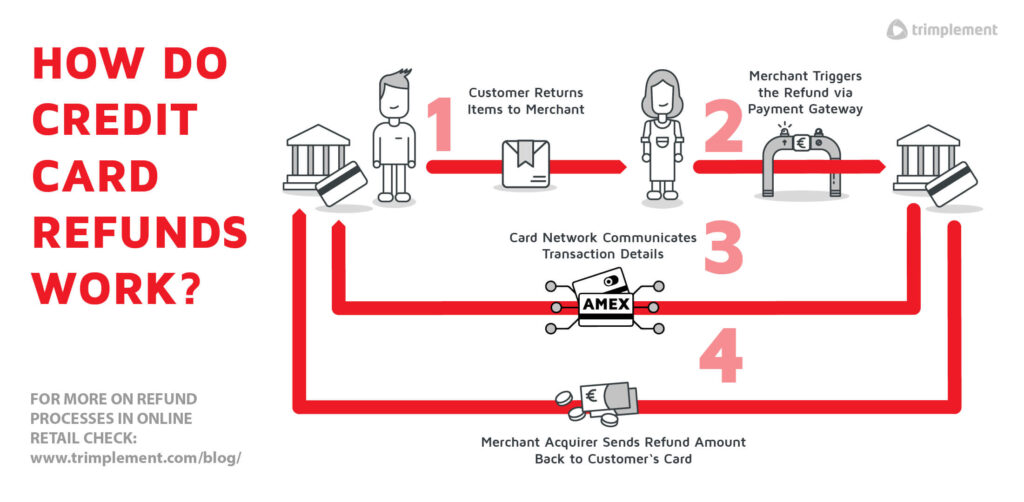

Example Flow of a Refund to Original Source of Payment (Credit Card)

In this example, refunding requires a middleman between the customer (called cardholder, as they own the issued credit card) and the merchant – the card issuer, which passed the money owed to the merchant by the customer.

1. Initiating the refund request

The customer requests a return for a purchase made using the credit card. This is typically done through the e-commerce platform’s return management system. Once the returned items arrive with the retailer, the refund process is initiated – in case the customer returns only a part of the purchase, it’s a partial refund.

2. Accepting the refund

The merchant verifies the eligibility of the refund request based on their refund policy. They check if the refund is within the specified time limits.

3. Gathering refund details

The merchant seeks out the data of the original payment transaction to start the refund process. The credit card data of the original transaction would be picked up automatically by the payment gateway. Yet, the merchant also collects and provides additional information related to the refund, such as the refund amount and reason for the refund. All this information is important for processing and tracking the refund.

4. Submitting refund request to the payment gateway

The merchant submits the refund request to the payment gateway integrated with the e-commerce platform. This involves providing the original transaction details and refund amount to the payment gateway’s API or in the payment administration UI.

5. Payment gateway processing

The payment gateway passes the refund request to the credit card network to initiate the refund transaction. The payment gateway ensures the refund amount is deducted from the merchant’s account and credited back to the consumer’s credit card.

6. Refund confirmation and notification

Once the refund transaction went down successfully, the payment gateway provides a confirmation to the merchant. The merchant then may update the refund status in their system and notify the consumer about the refund confirmation through email or any other preferred communication channel.

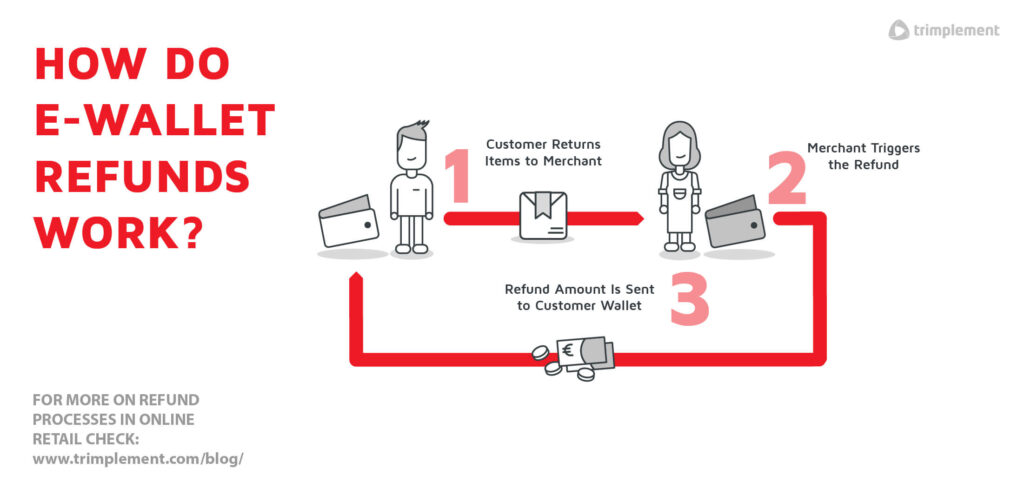

Example Flow of a Refund to E-Wallet (from Credit Card)

Here, refunds just happen within the e-commerce platform, which considerably cuts the timeframe of the refund – it could even cut it down to instant, in some cases. Typically the customer must give their agreement to the merchant, that the money may be refunded to the e-wallet and not the original source of payment. There are payment methods, where refunds to the original payment source may not be feasible at all, such as cash-on-delivery transactions.

1. Initiating the refund request

The customer initiates a refund request (see above). They choose that the money shall go to their on-platform e-wallet.

2. Accepting the refund

The retailer verifies the refund request (see above).

3. Gathering refund details

The retailer collects the necessary information related to the refund (see above).

4. Initiating the refund to an e-wallet

The merchant initiates the refund and the amount is transferred from the merchant’s wallet account to the customer’s wallet account. The refunded amount is instantly credited to the customer.

5. Refund confirmation and notification

See above.

As has become clear here, refunds to e-wallets are more straightforward than refunds to original payment sources (in the case of credit cards). The refund can take place directly on the e-commerce platform without the involvement of credit card networks or customer banks. That means that the customer can also spend it again there right away.

The most common payment methods that led to a refund after an e-commerce purchase:

- Credit cards (22.78%)

- Cash (12.69%)

- Debit cards (7.04%)

- Other (13%)

The Challenges of Refunds for E-Commerce Companies

Refunding is often a complex process – especially as it involves multi-vendor purchases and partial refunds. Deciding against a turnkey payment system in favor of a self-built e-wallet system can help avoid the following pain points in refund processing.

1. Costs

Refunds are already costly enough: For every $1 billion in sales, a retailer loses about $166 million in revenue due to returns. But decision-makers sometimes overlook another cost factor: Fees. Refunding purchases can, depending on the original payment source, incur additional fees from PSPs, banks, or credit card networks.

What Improves with E-Wallets

E-wallet refunds can help avoid the fees mentioned above. The money is transferred directly on the platform as an e-wallet balance. Subsequently, external payment providers do not have to be involved and they cannot charge any fees, too.

2. Customer Satisfaction

Refund processing times vary depending on the payment method. With some payment methods such as bank transfers, it may take several days or weeks for the customer to receive their refund which may reduce customer satisfaction.

What Improves with E-Wallets

E-wallet refunds can happen instantly. The refunded money will be added to a customer’s balance on the platform and they can spend it right away. They may also choose to withdraw it to their bank account at a later date.

Average Refunding Timeframes for Different Payment Methods

| Credit card | 3 to 5 business days |

| Debit card | Up to 10 business days |

| Checking account | Up to 10 business days |

| Promotional certificate | No refund issued |

| Shop with reward points | Up to 5 business days |

| Pay in cash (at a participating location) | Up to 10 business days |

| Pre-paid credit card | Up to 30 days |

3. Payment Method Support

Not all payment methods can support simple refund processing – especially if they have a physical component. For cash-on-delivery and voucher-based payments, for example, a refund to the original source of payment is not feasible. Many e-commerce platforms, therefore, exclude these payment methods from their refund policies. This places a particular burden on unbanked and underbanked customers, who need to be wary with their spending and therefore rely on refund options.

What Improves with E-Wallets

With an e-wallet system, merchants offer their customers refunds, which would otherwise not be possible with certain payment methods. Offering a broad variety of payment methods will positively affect conversion. For instance, 40% of customers are more likely to buy if they can do so using their preferred payment method.

4. Partial Refunds and Reconciliation

In the realm of online marketplaces, shopping baskets usually comprise of items from various merchants. With such multi-vendor purchases, it is not easy to handle refunds properly. Moreover, even in single-merchant online stores, customers may not always seek to return all items in their order, but keep some which also leads to a partial refund.

What Improves with E-Wallets

E-wallets prove advantageous in streamlining the refund process for both multi-vendor purchases and partial refunds. E-wallets record money transfers in a very detailed manner so that they can simplify the calculation of partial refunds and the reconciliation processing in cases of multi-vendor purchases, where keeping track of refunds from different sources can be challenging.

5+. And more

Aside from the factors listed above, unique enterprises may face unique challenges. For example, maybe your platform offers subscriptions. Maybe your customer can pay partially with loyalty points. Maybe you want to set up prepaid cards, making the platform more attractive to unbanked and underbanked customers. E-wallet systems can implement a variety of use cases.

Building an Instant Refund Solution for E-Commerce with CoreWallet

CoreWallet is a flexible payment and e-wallet software foundation for e-commerce enterprises, built by trimplement. It helps you establish a feature-rich e-wallet in just a few months.

CoreWallet comes with:

Flexible E-Wallets Configurations

CoreWallet enables you to design your e-wallet system according to your specific business needs. For instance, You can configure variable settings for merchant accounts regarding billing and settlement. Also, you can support guest checkout or full customer wallets to store core data and manage payment instruments. This versatility is complemented by customizable fee and limit settings (e.g., for AML compliance) and usage restrictions based on wallet type and customer verification level.

Multi-Payment Method and Currency Support

CoreWallet can integrate new payment methods within a short time frame, allowing you to give customers options they are familiar with and appreciate. What’s more, CoreWallet offers the flexibility to manage multiple currencies in a single business transaction and wallet. This includes virtual currencies and loyalty points which you can allow as a means of payment on the platform.

Integration Points for Third Parties

CoreWallet’s flexibility does not stop at the borders of its own code: The software comes with integration points to rapidly integrate 3rd party software like risk and fraud management solutions. This also helps your company to remain compliant with local regulations as you can implement AML, KYC, and CTF checks with ease.

End-to-End Support by Payment Experts

It’s not just the CoreWallet framework your company will obtain from us. On top, you will get comprehensive support from our solution architects and software engineers. They bring many years of experience in creating cutting-edge payment software to the table. Our team supports you in every step of the project from initial planning to post-launch optimization.

Solve Your Refund Problems – With Our Help!

At trimplement, we have over a decade of experience in planning, building and maintaining high-performing payment and e-wallet systems. Join us for a free consulting session and we discuss together, how we can solve your refund problems in a flexible and cost-effective manner.